We’ve already heard quite a bit about apartment rents falling after the outbreak of the coronavirus. They peaked on March 10, and began an earnest decline over the next month-and-a-half.

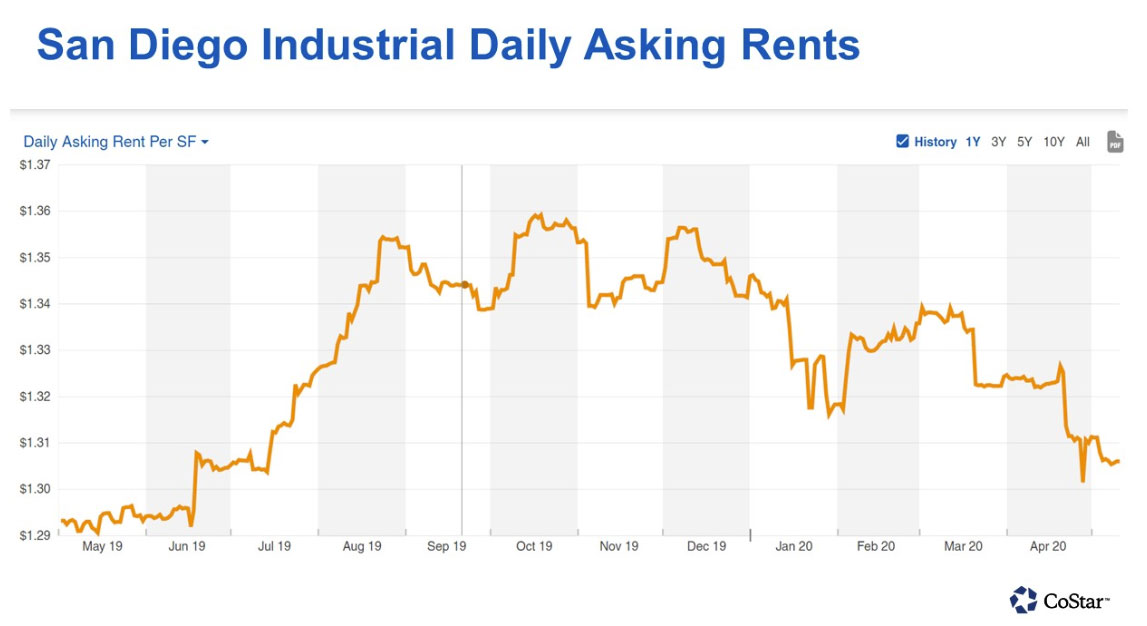

But what’s been less discussed is the fall in industrial rents. Much like CoStar’s daily rent series for apartments, CoStar tracks daily asking rents in the industrial sector. In the same time frame, beginning on March 11 through the end of April, industrial asking rates across the San Diego region declined by $0.04 per square foot.

Quantitative data is typically not daily in the commercial world. But it was the largest fall in industrial asking rents over a six-week period in the past two years, and it happened to coincide with the coronavirus outbreak.

CoStar uses Oxford Economics for its employment forecasts that are then fed into our proprietary property market forecasts.

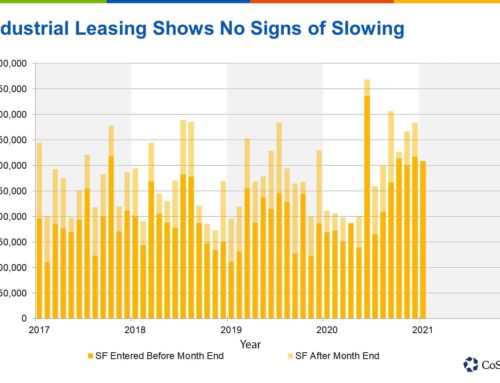

The industrial sector is widely perceived to be able to weather the coronavirus outbreak better than other commercial property sectors. Distribution, warehouse and lab properties may be better positioned that other property types, as e-commerce has taken on an even greater role from residents sheltering in place.

Even so, under Oxford Economics’ guidance, rent growth is expected to turn negative in 2020. That comes after recording 33 straight quarters of positive rent growth.

Under Oxford Economics baseline scenario, annual rent growth falls by more than 5% by the end of 2020. But the sector largely recovers rent losses by the beginning of 2022. That lines up with when total employment in San Diego returns to the first quarter levels of this year.

Under a moderate downside scenario, employment gains would return to the region in the second half of 2020, although total employment would not return to first quarter levels over the next five years, and employment growth would be rather weak. Rent losses would exceed 10% and last until the end of 2021, recording five quarters of annual rent declines.

In a severe downside scenario, job losses last through 2021 in San Diego. Rents fall in the region’s industrial sector for as long as they do in the moderate downside scenario, only with a steeper decline, falling more than 10% by the end of 2021 with a trough of more than 15% in the first quarter 2021.

For comparison, rent losses during the Great Recession troughed at almost 6% during the first quarter of 2010. But annual rent growth turned negative before the end of 2008, and it did not return to positive territory until the beginning of 2012. That was more than three years of rent declines before recovery set in.

While CoStar’s current forecasts do not anticipate rent losses lasting as long as they did during the Great Recession, they are forecast to begin falling by the end of 2020 with a shorter horizon. Logistics space is anticipated to fare better than other industrial sectors, although logistics is not expected to be immune from coming rent losses.

See Original Article:

https://product.costar.com/home/news/shared/1432607656

Leave A Comment