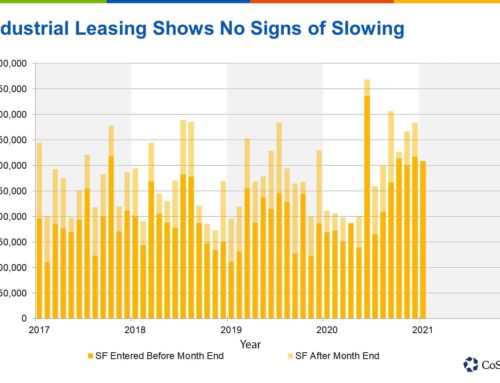

As we finish the first quarter, we have now eclipsed one year since the initial COVID-19 outbreak. While the after-effects on the business world have left millions unemployed, and clobbered vast swaths of the economy, strikingly, the industrial real estate sector is coming out stronger than a year ago.

One of the pillars of San Diego has long been the biotech and life sciences industry, and that is more evident now than ever. Throughout the past year biotechnology and life sciences has been the single largest catalyst of growth in San Diego. This has accelerated some trends that were already present in the market, such as the conversion of office, R&D, and industrial buildings for lab use. This trend is most visible in the Downtown submarket which went from having no significant biotech presence to now being on the verge of becoming the next major secondary biotech hub in San Diego County, along with North County. IQHQ acquired 8+ acres on the Downtown San Diego bayfront for development of a landmark life sciences campus, and Stockdale Capital Partners which bought the Horton Plaza Mall for redevelopment has expanded their initial focus beyond hi-tech to target biotech as well. The latest domino to fall was the purchase of the former Thomas Jefferson Law School building in Downtown San Diego. This 8-story 200,000 square foot building was built in 2011 and was recently purchased by P3RE for conversion to lab use. While Downtown stands out because of its visibility, this conversion trend has been ongoing in the submarkets surrounding UCSD. This has funneled the strong demand for biotech and lab space into office, flex, and industrial properties. Numerous developers and operators such as BioScience Properties are working their way through Sorrento Mesa snapping up properties for conversion. The biotech influence continues to creep towards the east farther into Miramar.

As devastating as the past year has been, it is incredible to realize that rental rates and sales prices have never been higher in San Diego industrial and R&D real estate. For companies in the market looking to buy a facility for their business, they are typically competing with multiple other offers, including stronger offers of all cash, or a shorter escrow period.

All signs point towards the U.S. having turned the corner on the COVID-19 pandemic. Some things will never go back to how they were before March 2020. Amazon, which has single-handedly accounted for hundreds of thousands of square feet worth of demand in the past year, will not be going back to the footprint that it had pre-COVID. That being said, there will be some bounce back in certain industrial businesses which were set back by the pandemic. As California moves to open up vaccination eligibility to all adults in the next month, we will eventually see some return of the service-related uses which have taken a big hit, such as food service, entertainment, etc. The San Diego industrial market is moving forward as strong as ever.

by Chris Duncan

VICE PRESIDENT / Partner, SAN DIEGO

858.458.3307 . Lic. #01324067

Leave A Comment