San Diego is firmly cemented as one of the top life sciences markets in the United States, and that status has only grown stronger during the pandemic as many local firms have been involved is some aspect of research and development related to COVID-19.

Venture capitalists have taken notice, and funding has accelerated. Local startups raised a record $4.9 billion in 2020, according to data from Connect/San Diego Venture Group and Pitchbook, and that number was nearly eclipsed during the first half of 2021 after $2.4 billion and $2 billion were raised over the first and second quarters, respectively.

Data shows that life science firms dominate local fundraisings, and seven biotech firms raised more than $100 million during the second quarter, including Element Biosciences, which raised $276 million. Element Biosciences recently committed to the entire 175,000-square-foot Alexandria Tech Center in Sorrento Mesa that broke ground at the end of 2020 and will expand from 30,000 square feet in University Town Center.

Cue Health was another to eclipse $200 million in the second quarter. Cue Health took possession of its 200,000-square-foot facility in Vista in 2021 after receiving a nearly $500 million grant from the United State Department of Defense to produce rapid COVID-19 testing kits and more than $100 million in funding in 2020. CUE Health also leased 60,000 square feet in Sorrento Mesa in 2020, adding to its 20,000-square-foot occupancy there.

Already, several life science and tech firms have raised more than $100 million in the third quarter, setting the San Diego region up for another record-breaking year of fundraising. One of those firms is Erasca, a clinical-stage precision oncology company that raised $200 million last year and $300 million in an initial public stock offering in July. Erasca leased 80,000 square feet in Torrey Pines at Spectrum III, a project under development by Alexandria Real Estate Equities scheduled for completion in 2022. That will be a significant expansion from less than 20,000 square feet in the submarket.

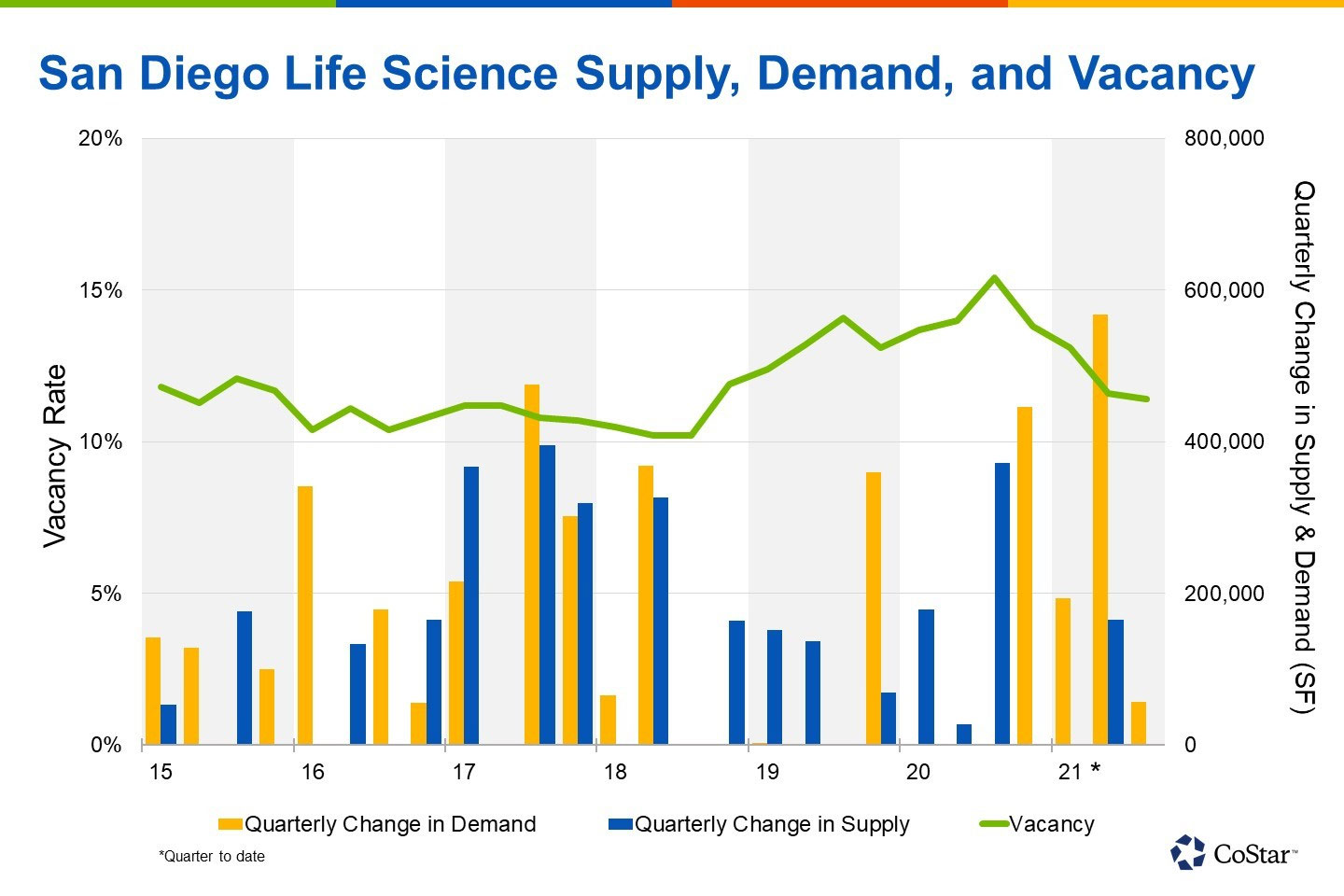

San Diego’s overall office market has endured rising vacancies, climbing year over year to 12%, falling occupancies, which are down 500,000 square feet in the past year, and stagnant rent growth over that same period.

Unlike the disruption seen in the broader office market in the region, the life science market has encountered much less turbulence. The vacancy rate has fallen 3.5% in the past 12 months, 1.2 million square feet was absorbed year over year, and rents have grown 3.5% over that stretch. Asking rents for new lab space often approaches $5 per square foot on a monthly, triple-net basis, and landlords often achieve that price.

Already in 2021, 180 leases have been signed totaling 2.1 million square feet. Both numbers are already ahead of the totals for each of the first three quarters from 2017 through 2020.

The life science pipeline is primarily concentrated in the Sorrento Mesa and Torrey Pines areas, where under-renovation projects and ground-up developments are underway. Both areas are the most active for life sciences firms, particularly among those in expansion mode. Sorrento Mesa, in particular, has been one of the most heavily invested markets in San Diego among national and international firms, and many office buildings and campuses have been targeted for redevelopment into lab space. If anything, San Diego may not have enough space to accommodate the level of demand for lab space there.

Only a handful of buildings across the San Diego office market have more than 50,000 square feet of available lab or research and development space, several of which are under renovation, and very little of it is in ground-up development.

That will change with the new IQHQ development rising along the Embarcadero in downtown. The first phase of the 1.1 million-square-foot lab campus is set to break ground before the end of 2021 and could lead to a secular shift in biotech demand in San Diego. Historically, downtown receives almost none of that demand, although several buildings in the city’s central business district are poised to capitalize on the red-hot market, including Phase 3’s Genesis building in the East Village and possibly the Campus at Horton, which held its topping off ceremony a few months back and shifted from attracting traditional office users to tech and life science tenants.

Original News Article:

https://product.costar.com/home/news/shared/1973581409?source=sharedNewsEmail

Leave A Comment