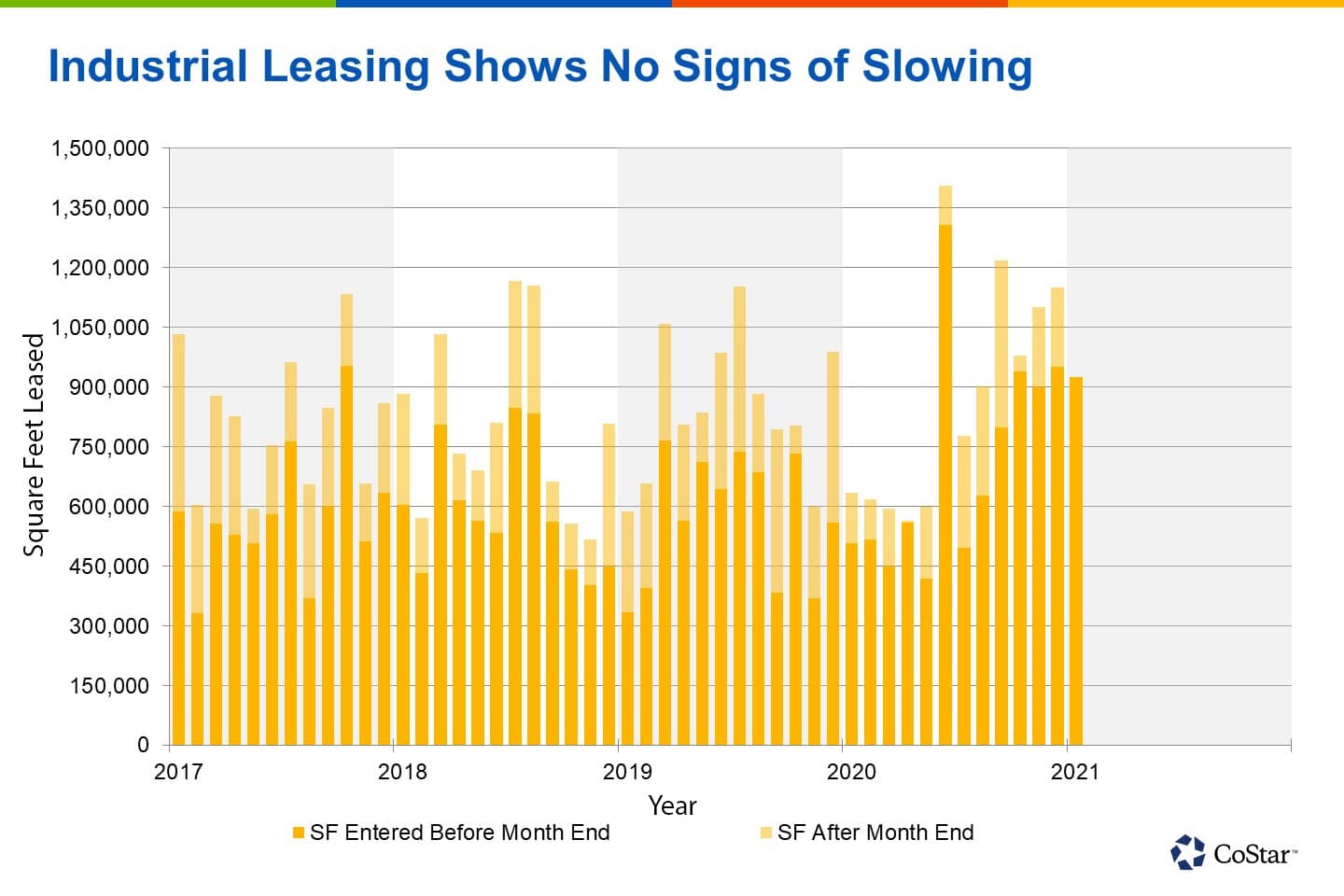

Industrial leasing volume in San Diego is holding up remarkably well during the pandemic. The retrenchment in the office and retail sectors simply hasn’t materialized in the industrial sector. Quarterly leasing volume averaged more than 3 million square feet in the final three quarters of 2020, with the first quarter of 2021 on pace to reach that level again.

San Diego’s industrial foundation is well-balanced between high demand for logistics space that can satisfy the needs of last-mile distribution and e-commerce tenants as well as the demand for lab space within flex buildings that can accommodate the cutting-edge requirements of the region’s life science firms. That combination should help the market maintain stability, even in an unstable economic environment.

Retail and office tenants have exercised much more restraint in their space needs over the past year. The average retail and office lease signed amid the pandemic has fallen by roughly 17% and 27%, respectively, compared with the average lease signed from the start of 2018 through the first quarter of last year. The industrial sector has experienced no such moderation. The average lease size has actually increased amid the pandemic by 250 square feet compared to the prior period.

Amazon grabs the headlines when it signs a new lease, and rightfully so. The e-commerce giant leased more than 800,000 square feet of logistics space in 2020 and another 45,000 square feet of flex space in University Town Center. But it wasn’t the only firm expanding in the region since the outbreak to accommodate logistics and last-mile needs.

Hillebrand leased more than 100,000 square feet in Otay Mesa during the third quarter for its first physical presence in the region, Walmart leased 90,000 square feet in Santee during the fourth quarter and OnTrac leased a similar amount of space at the Pacific Vista Commerce Center in Carlsbad during the first quarter of 2021, to name just a few.

Life science firms in expansion mode are also driving leasing activity. CUE Health leased 200,000 square feet at the Vista Business Park in the fourth quarter and took immediate possession of the space. CUE Health received a nearly $500 million award from the Department of Defense to produce fast, portable COVID tests. But that was not the firm’s only expansion in San Diego in 2020. It added more than 60,000 square feet of flex space in Sorrento Mesa in June to its original 20,000-square-foot space in that local market.

Zentalis Pharmaceuticals leased two buildings and nearly 120,000 square feet at Healthpeak’s Boardwalk development in Torrey Pines in October. That was the second big lease for Zentalis in Torrey Pines in 2020. It also leased nearly 40,000 square feet at ARE Torrey Ridge at the beginning of the year. Those deals were an expansion from 10,000 square feet within the market.

More than $6 billion in venture capital poured into San Diego in 2020, nearly doubling the amount raised in 2019, according to the National Venture Capital Association and PitchBook. Most of that investment capital targeted startups in San Diego’s biotech and life science industries as many of the region’s firms were involved in COVID-related work.

Original Article:

Leave A Comment