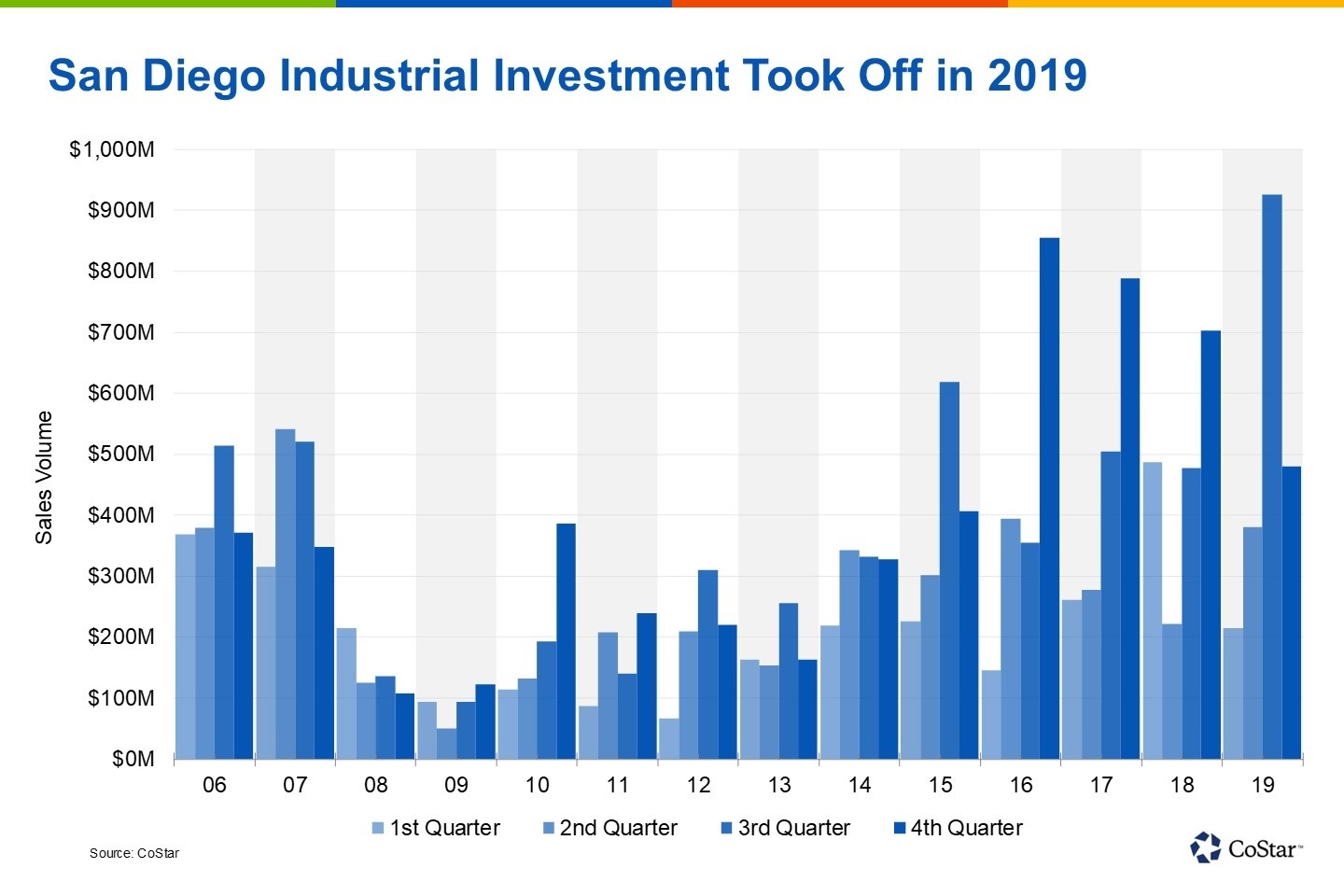

Industrial investment in the San Diego metropolitan area exploded in 2019, establishing a new annual high for sales volume at $2 billion. Last year was the sixth straight year that annual sales volume increased and the first time it reached $2 billion. That came as demand remains strong while rent growth peaked at the beginning of 2019.

More than 50% of that volume originated from institutional, private equity or REIT concerns. The biggest deals gravitated to San Diego’s core tech and life science hubs in the University of California, San Diego area and Sorrento Mesa, and one REIT was involved in all of them.

In July 2019, as part of a joint venture, Alexandria Real Estate Equities acquired a 55% interest in the Genesis Campus in University Town Center for an estimated $255 million. It was rebranded Campus Pointe by Alexandria. The campus had recently been renovated and it was filled with a mix of pharmaceutical companies. Bain Capital and Phase 3 Real Estate sold the campus at one of the highest industrial valuations in the past decade.

In September, Alexandria Real Estate Equities sold a 49% interest in the Illumina World Headquarters Campus in UTC for $287 million at a 4.7% capitalization rate. LaSalle Investment Management purchased the partial interest in the office and research and development campus where Illumina had 12 years remaining on its lease.

Alexandria capped off the year by purchasing a 50% interest in the San Diego Tech Center in Sorrento Mesa for $230 million from the California State Teacher’s Retirement System in October. The 10-building campus consists of a mix of R&D and office buildings and sold five years earlier for $256 million. Sony and Qualcomm were tenants, although Sony moved out of roughly 200,000 square feet of flex space in the third quarter. Qualcomm followed that up by moving out of 75,000 square feet at the end of 2019.

CoStar Group estimates that industrial market prices, the estimated pricing movement of all properties in the market and informed by actual transactions, rose more than 5% in 2019 to $230 per square foot. Given steady rent growth and strong demand, strong pricing growth is expected to continue in the near term before moderating toward the end of the forecast.

And it is expected that market capitalization rates are likely to remain near 5.5%. The rate has held firm at that yield for more than two years.

See Original Article

https://product.costar.com/home/news/shared/55458734?source=sharedNewsEmail

Leave A Comment